Navigating the world of critical illness insurance can feel overwhelming. With numerous providers and a wide array of policy features, choosing the right coverage requires careful consideration. This comprehensive guide will equip you with the knowledge and tools to effectively compare critical illness insurance policies in 2025, ensuring you find the best protection for your needs and budget.

Understanding Critical Illness Insurance: A Foundation for Comparison

Before diving into comparisons, it’s crucial to grasp the fundamentals of critical illness insurance. This type of insurance provides a lump-sum payout upon diagnosis of a specified critical illness, such as cancer, heart attack, stroke, or kidney failure. This payout can help cover medical expenses, lost income, and other related costs. Unlike health insurance, which covers medical treatment, critical illness insurance offers financial support regardless of the treatment’s success.

Key Features to Consider When Comparing Policies:

- Covered Illnesses: Policies vary in the specific critical illnesses they cover. Some offer broader coverage, including less common conditions. Carefully review the policy’s definition of each illness and ensure it aligns with your risk profile. Look for policies that cover conditions like Parkinson’s disease, multiple sclerosis, and Alzheimer’s disease, in addition to more common critical illnesses.

- Payout Amount: This is the lump-sum amount you receive upon diagnosis. Consider your potential financial needs in case of a critical illness. Higher payout amounts offer greater financial security but typically come with higher premiums.

- Waiting Period: This is the time period after policy inception before coverage begins for a specific illness. Shorter waiting periods are generally preferable, but they may increase premiums.

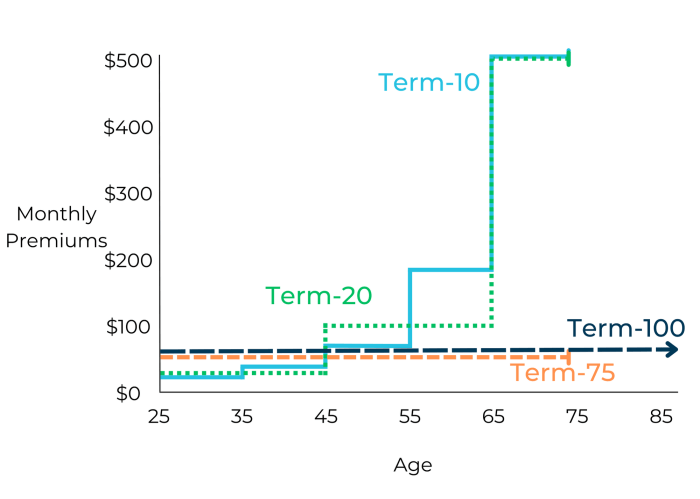

- Premium Payment Options: Policies offer various payment options, including monthly, quarterly, semi-annually, and annually. Choose an option that aligns with your budget and financial planning.

- Renewal Options: Understand the policy’s renewal terms. Some policies are guaranteed renewable, meaning the insurer cannot cancel your coverage, while others may be subject to changes in premiums or coverage based on age or health.

- Benefit Payment Options: Some policies offer flexibility in how the benefit is paid out (e.g., lump sum, installments). Consider which option best suits your financial needs.

- Multiple Claims Benefit: Some policies allow for multiple claims for different critical illnesses, even within the same policy period. This is crucial to consider for increased financial protection.

- Early Stage Diagnosis Benefit: Some policies offer partial payouts for early-stage diagnoses, providing financial assistance even before the illness progresses significantly. This can be particularly helpful for managing treatment costs.

- Return of Premium Option: Certain policies offer a return of premiums if no claim is made during the policy term. This can be a beneficial feature, although premiums will likely be higher.

- Claim Process: Investigate the insurer’s claim process. A straightforward and efficient claim process can minimize stress during a challenging time. Look for insurers with transparent and readily available claim procedures and customer support.

Step-by-Step Guide to Comparing Critical Illness Insurance Policies

- Assess Your Needs: Determine your desired payout amount, considering potential medical expenses, lost income, and other financial obligations. Identify the critical illnesses you want covered.

- Obtain Quotes from Multiple Insurers: Contact several reputable insurance providers to obtain personalized quotes. Be sure to provide accurate information about your age, health, and desired coverage.

- Compare Policy Features: Carefully compare the features of each policy, paying close attention to the covered illnesses, payout amounts, waiting periods, premiums, and other relevant factors. Use a comparison table to organize your findings.

- Review Policy Documents: Thoroughly review the policy documents before making a decision. Pay particular attention to the fine print, exclusions, and conditions.

- Check the Insurer’s Financial Stability: Research the financial stability of each insurer to ensure they can meet their obligations. Look for ratings from reputable financial rating agencies.

- Consider Your Budget: Choose a policy that fits comfortably within your budget while providing adequate coverage.

- Seek Professional Advice: Consult with a qualified financial advisor or insurance broker for personalized guidance.

Frequently Asked Questions (FAQs)

- Q: How much critical illness insurance do I need? A: The amount of coverage depends on your individual circumstances, including your age, health, income, existing savings, and potential financial obligations in case of a critical illness. A financial advisor can help you determine the appropriate coverage amount.

- Q: When is the best time to buy critical illness insurance? A: It’s generally advisable to purchase critical illness insurance while you are young and healthy, as premiums are typically lower. However, it’s never too late to obtain coverage.

- Q: What are the common exclusions in critical illness insurance policies? A: Common exclusions may include pre-existing conditions, self-inflicted injuries, and illnesses resulting from risky behaviors. Carefully review the policy’s exclusions to understand what is not covered.

- Q: Can I increase my coverage later? A: The ability to increase coverage later depends on the policy terms and your health status. Some policies allow for increased coverage, while others may have restrictions.

- Q: What happens if I change jobs? A: Your critical illness insurance policy remains in effect regardless of your employment status. However, you may need to notify your insurer of any address changes.

- Q: How long does the claim process take? A: The claim process timeframe varies depending on the insurer and the complexity of the claim. It’s essential to follow the insurer’s instructions and provide all necessary documentation promptly.

Choosing the Right Critical Illness Insurance: A Final Word

Selecting the appropriate critical illness insurance policy is a crucial step in safeguarding your financial well-being. By carefully comparing policies based on the factors discussed above and seeking professional advice when needed, you can make an informed decision that provides peace of mind and protects your future.

Source: briansoinsurance.com

Resources:

Call us today for a free consultation and let us help you find the perfect critical illness insurance policy!

FAQ Corner

What is the difference between a critical illness policy and a health insurance policy?

Critical illness insurance provides a lump-sum payment upon diagnosis of a specified critical illness, while health insurance covers medical expenses related to illness or injury.

How long does it take to receive a payout after a claim?

The processing time varies by insurer, but generally ranges from a few weeks to a few months, depending on the complexity of the claim.

Source: ffga.com

Can I increase my coverage amount later?

Some insurers allow policyholders to increase their coverage amount, often subject to underwriting and health assessments.

What happens if I am diagnosed with a condition not listed in the policy?

The policy will not pay out if the condition is not specifically listed as a covered critical illness within the policy document.

Are there waiting periods before coverage begins?

Source: prweb.com

Yes, most policies have waiting periods, typically ranging from 30 to 90 days, before coverage begins for newly diagnosed illnesses.