In today’s unpredictable world, securing your financial future is paramount. While health insurance covers medical expenses during illness, it often falls short when dealing with the devastating financial impact of a critical illness. This is where critical illness insurance steps in, providing a crucial safety net for you and your loved ones. This comprehensive guide will delve into the intricacies of critical illness insurance, explaining what it covers, why you need it in 2025, and how it can safeguard your financial well-being.

What is Critical Illness Insurance?

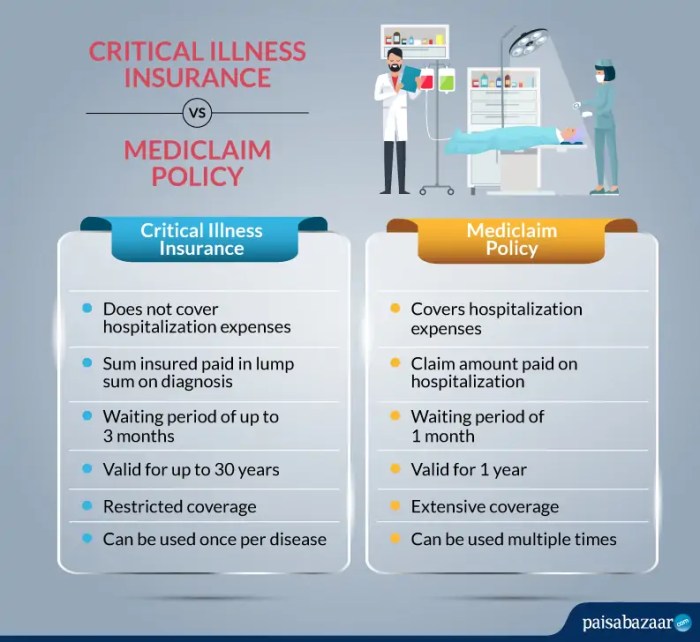

Critical illness insurance is a type of supplemental health insurance that provides a lump-sum payout upon diagnosis of a specified critical illness. Unlike health insurance, which covers medical expenses, critical illness insurance focuses on the financial burden associated with a serious illness. This lump sum can be used to cover a wide range of expenses, from medical bills and rehabilitation costs to lost income and everyday living expenses.

The policy typically covers a defined list of critical illnesses, and the payout amount is determined at the time of policy purchase.

What Critical Illnesses are Typically Covered?

The specific illnesses covered vary between insurers, but common critical illnesses included in most policies are:

- Cancer

- Heart attack

- Stroke

- Kidney failure

- Paralysis

- Major organ transplant

- Multiple sclerosis

- Alzheimer’s disease

- Parkinson’s disease

- Blindness

- Loss of limbs

Some policies may also cover less common critical illnesses, and some insurers offer options to customize your coverage based on your specific needs and risk factors. It’s crucial to carefully review the policy wording to understand exactly which illnesses are covered.

Why You Need Critical Illness Insurance in 2025

The need for critical illness insurance is more relevant than ever in

2025. Several factors contribute to this:

Rising Healthcare Costs:

Healthcare costs continue to escalate globally. Even with comprehensive health insurance, out-of-pocket expenses related to critical illnesses can be astronomical, potentially leading to significant financial strain. Critical illness insurance helps mitigate these costs, allowing you to focus on recovery rather than financial worries.

Source: shortpixel.ai

Increased Lifespan and Chronic Diseases:

People are living longer, increasing the likelihood of developing chronic illnesses. These illnesses often require extensive treatment, rehabilitation, and ongoing care, all of which can be financially burdensome. Critical illness insurance provides a financial buffer to help manage these long-term costs.

Lost Income Due to Illness:

A critical illness can often lead to lost income, either due to inability to work or the need for a caregiver. Critical illness insurance can replace this lost income, ensuring financial stability during a challenging time.

Unexpected Expenses:

Beyond medical bills, critical illnesses often incur unexpected expenses, such as home modifications for accessibility, specialized equipment, or travel costs for treatment. The lump-sum payout from critical illness insurance can cover these unforeseen costs.

Protecting Your Family:

Critical illness insurance isn’t just about protecting yourself; it’s about protecting your family. The financial burden of a critical illness can significantly impact your family’s financial stability. A critical illness payout can alleviate this burden and ensure your family’s financial security.

Choosing the Right Critical Illness Insurance Policy

Selecting the right critical illness insurance policy requires careful consideration of several factors:

- Coverage Amount: Determine the appropriate coverage amount based on your individual needs and potential expenses. Consider factors like medical costs, lost income, and rehabilitation costs.

- List of Covered Illnesses: Compare the list of covered illnesses offered by different insurers to ensure it aligns with your risk profile.

- Waiting Period: Understand the waiting period before coverage becomes effective. This period typically ranges from 30 to 90 days.

- Premium Costs: Compare premium costs from different insurers to find a policy that fits your budget. Remember, higher coverage amounts typically result in higher premiums.

- Policy Exclusions: Review the policy exclusions carefully to understand what conditions are not covered.

- Insurer’s Reputation and Financial Stability: Choose a reputable insurer with a strong financial standing to ensure the payout when needed.

Frequently Asked Questions (FAQ)

- Q: What is the difference between critical illness insurance and health insurance?

A: Health insurance covers medical expenses incurred during illness, while critical illness insurance provides a lump-sum payout upon diagnosis of a specified critical illness, regardless of medical expenses. - Q: How much critical illness insurance coverage do I need?

A: The ideal coverage amount depends on your individual circumstances, including your income, living expenses, and potential medical costs. It’s recommended to consult a financial advisor to determine the appropriate coverage amount. - Q: Can I claim critical illness insurance multiple times?

A: Most policies only provide a single payout for each covered illness. However, some policies may offer multiple payouts for different illnesses. - Q: What happens if I don’t make a claim within the specified time frame?

A: Each policy has a time limit for claims. Missing the deadline may result in forfeiture of the benefit. Review the policy details carefully. - Q: Can I get critical illness insurance if I have a pre-existing condition?

A: Insurers may have different underwriting guidelines. Some may offer coverage with exclusions or higher premiums. Disclosure of pre-existing conditions is crucial during the application process. - Q: How much does critical illness insurance cost?

A: Premiums vary depending on several factors, including age, health status, coverage amount, and the insurer. Obtaining quotes from different insurers is recommended.

Conclusion

Critical illness insurance provides a vital financial safety net in the face of unforeseen health challenges. In 2025, with rising healthcare costs and increased longevity, securing this type of coverage is a prudent decision for protecting yourself and your family’s financial future. Don’t wait until it’s too late; take proactive steps today to secure your financial well-being.

References

While specific links to insurance company websites are avoided due to their dynamic nature and potential for changes, you can find reliable information on critical illness insurance from reputable financial websites and consumer protection agencies in your country. Search for terms like “critical illness insurance comparison,” “best critical illness insurance providers,” and “critical illness insurance reviews” to find relevant information.

Source: co.in

Call to Action

Ready to secure your financial future? Contact us today for a free consultation and personalized quote on critical illness insurance. Let us help you find the right coverage to protect what matters most.

Common Queries

What is the difference between critical illness insurance and disability insurance?

Critical illness insurance pays a lump sum upon diagnosis of a specific illness, regardless of your ability to work. Disability insurance, on the other hand, replaces a portion of your income if you become unable to work due to illness or injury.

Source: bajajallianz.com

How much critical illness insurance coverage do I need?

The amount of coverage depends on your individual circumstances, including your age, health, lifestyle, existing debts, and financial goals. It’s advisable to consult with a financial advisor to determine the appropriate level of coverage.

Can I get critical illness insurance if I have pre-existing conditions?

Insurers may assess your health history and may adjust premiums or coverage based on pre-existing conditions. Some insurers may offer coverage with exclusions for specific conditions.

What types of critical illnesses are typically covered?

Commonly covered illnesses include cancer, heart attack, stroke, kidney failure, and major organ transplants. However, specific coverage varies depending on the policy.