Critical illness insurance provides a crucial financial safety net for individuals diagnosed with severe illnesses. However, it’s essential to understand its limitations to make informed decisions about your coverage. This comprehensive guide explores the potential shortcomings of critical illness insurance in 2025, considering evolving medical advancements and insurance industry practices.

Defining Critical Illness Insurance and its Core Purpose

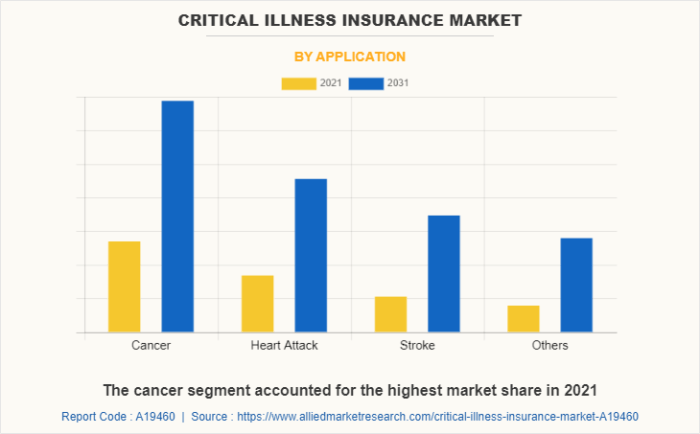

Critical illness insurance is a type of health insurance that pays out a lump sum if you’re diagnosed with a specified critical illness, such as cancer, heart attack, stroke, or kidney failure. The payout is designed to help cover medical expenses, lost income, and other financial burdens associated with a serious illness. It differs from health insurance, which covers medical treatment costs directly, and life insurance, which provides a death benefit to beneficiaries.

Understanding this fundamental difference is crucial to avoid unrealistic expectations.

Limitations of Critical Illness Insurance in 2025

1. Definition and Coverage of Critical Illnesses

The specific illnesses covered vary widely between policies. While most policies cover common critical illnesses, the definitions can be restrictive. For instance, a policy might define a heart attack narrowly, excluding certain types of heart events. Similarly, the definition of cancer may not encompass all types or stages of the disease. Always carefully review the policy wording to understand precisely what conditions are covered and the specific criteria that must be met for a claim to be approved.

This is particularly crucial given the ongoing advancements in medical diagnoses and treatment, leading to more nuanced definitions of illnesses.

2. Waiting Periods and Exclusions

Many critical illness policies include waiting periods, typically ranging from 30 to 90 days after the policy’s commencement, before coverage begins. This means if you develop a critical illness during the waiting period, you won’t receive a payout. Additionally, policies usually exclude pre-existing conditions. This means that if you have a health issue before purchasing the policy, it may not be covered even if it later develops into a critical illness.

Understanding these waiting periods and exclusions is paramount before purchasing a policy.

3. Limited Coverage for Emerging Illnesses

Medical science is constantly evolving, leading to the identification of new diseases and conditions. Critical illness policies often lag behind these advancements. Policies might not cover newly emerging critical illnesses, leaving individuals vulnerable to significant financial hardship if they develop a condition not explicitly listed in their policy document. This highlights the importance of regularly reviewing your policy and considering supplemental coverage options as medical understanding evolves.

4. Inflation and the Cost of Treatment

The payout amount from a critical illness policy is fixed at the time of purchase. However, the cost of medical treatment, particularly for serious illnesses, tends to rise over time due to inflation and advancements in technology. The payout might not be sufficient to cover all medical expenses, rehabilitation costs, and lost income, especially years after purchasing the policy.

Consider purchasing policies with inflation-linked benefits or supplementary savings plans to mitigate this risk.

5. Claim Process and Potential Delays

Submitting a claim and receiving a payout can be a complex and time-consuming process. Insurance companies require extensive documentation, including medical reports and diagnoses, which can delay the payment. This delay can create further financial strain during a time of crisis. Understanding the claims process and the potential for delays is essential to manage expectations and prepare for potential financial challenges during the waiting period.

6. Policy Renewals and Increased Premiums

As you age, the risk of developing a critical illness increases, and insurance companies often adjust premiums accordingly. Premiums can rise significantly upon policy renewal, potentially making it unaffordable to maintain coverage. Carefully consider the long-term cost implications and the possibility of needing to adjust your coverage or seek alternative solutions as you get older.

Source: alliedmarketresearch.com

Choosing the Right Critical Illness Insurance Policy

To mitigate the limitations, careful consideration is necessary when selecting a critical illness insurance policy. Look for policies with:

- Comprehensive definitions of critical illnesses.

- Shorter waiting periods.

- Options for increasing coverage amounts to account for inflation.

- Transparent claim procedures.

- Favorable terms and conditions.

It’s also advisable to compare policies from different providers to ensure you’re getting the best value for your money.

Frequently Asked Questions (FAQ)

- Q: What happens if my critical illness is not listed in the policy? A: Unfortunately, you will not receive a payout if your illness is not explicitly included in the policy’s definition of covered critical illnesses.

- Q: Can I claim for multiple critical illnesses? A: This depends on the specific policy. Some policies allow for multiple claims, while others might only cover one critical illness during the policy term.

- Q: What if I develop a pre-existing condition? A: Most policies will not cover conditions that existed before the policy’s commencement. It’s crucial to disclose all pre-existing conditions during the application process.

- Q: How long does the claims process take? A: The claims process varies depending on the insurer and the complexity of the case. It can take several weeks or even months to receive a payout.

- Q: Can I cancel my policy? A: Yes, you can usually cancel your policy, but you might not receive a full refund of your premiums, depending on the policy terms and conditions.

Resources

For further information and to compare critical illness insurance policies, you can consult the following resources:

- NHS Website (UK)

-Provides general information on critical illnesses. - [Insert link to a reputable insurance comparison website]

- [Insert link to a reputable financial advice website]

Call to Action

Protecting yourself and your family from the financial burdens of a critical illness is essential. Take the time to understand the limitations of critical illness insurance and choose a policy that best suits your individual needs and circumstances. Contact a financial advisor today for personalized guidance on securing the right critical illness coverage.

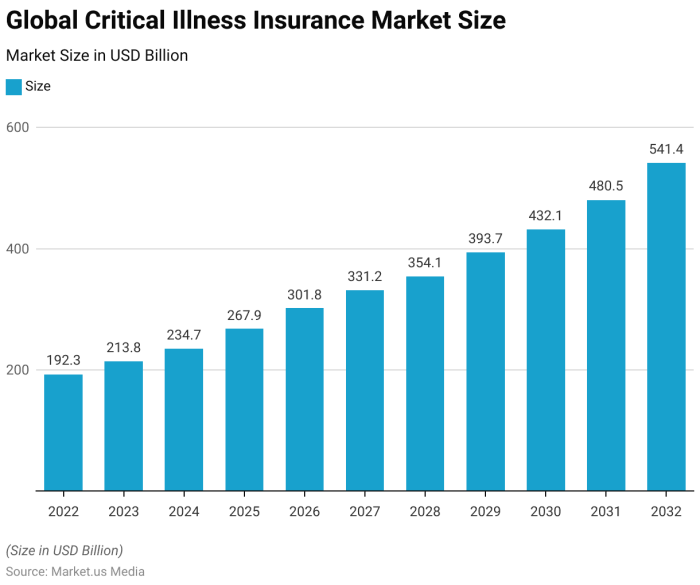

Source: market.us

Detailed FAQs

What if my critical illness isn’t explicitly listed in the policy?

Many policies list specific illnesses. If your illness isn’t explicitly named, it may not be covered. Carefully review the policy’s definition of covered illnesses.

Source: briansoinsurance.com

Can I increase my coverage amount after the policy is issued?

This depends on your insurer and policy type. Some policies allow for increases, often subject to medical underwriting and increased premiums.

How does inflation affect the payout amount?

The payout is typically a fixed sum, meaning its real value decreases over time due to inflation. This is an important consideration when assessing long-term financial security.

What happens if I make a claim and it’s denied?

Your policy will Artikel the appeals process. You usually have the right to challenge a denial, often involving providing additional medical documentation.