The question of whether you can add critical illness insurance to your existing health plan in 2025 is a common one, and the answer isn’t a simple yes or no. It depends on several factors, including your current health plan provider, the type of health plan you have, and the specific critical illness insurance policy you’re considering. This comprehensive guide will delve into the intricacies of adding critical illness insurance to your existing health coverage, providing clarity and empowering you to make informed decisions.

Understanding Critical Illness Insurance and Health Plans

Before we explore the feasibility of combining these two types of insurance, let’s define each one:

Critical Illness Insurance: A Financial Safety Net

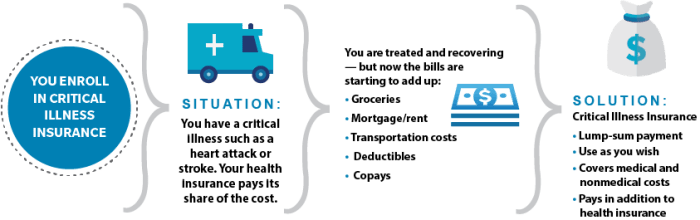

Critical illness insurance is a supplemental insurance policy designed to provide a lump-sum payout upon diagnosis of a specified critical illness, such as cancer, heart attack, stroke, or kidney failure. This payout can help cover medical expenses not covered by your health insurance, lost income due to disability, and other related costs. It acts as a financial buffer during a challenging time, allowing you to focus on your recovery rather than financial worries.

Key aspects to consider include the definition of covered illnesses, the payout amount, and any waiting periods.

Source: market.us

Health Insurance: Essential Medical Coverage

Health insurance, on the other hand, covers the costs associated with medical treatment, hospitalization, and other healthcare services. Different health plans offer varying levels of coverage, from basic plans to comprehensive plans with extensive benefits. Understanding your current health plan’s coverage limitations is crucial when considering additional insurance like critical illness coverage. Factors such as deductibles, co-pays, and out-of-pocket maximums play a significant role in determining your overall healthcare costs.

Adding Critical Illness Insurance: What You Need to Know

The process of adding critical illness insurance to your existing health plan varies greatly depending on your provider and the specific policies involved. It’s not always a straightforward addition like adding a rider to your auto insurance.

Compatibility with Existing Plans

Many health insurance providers don’t directly offer critical illness insurance as an add-on to their existing plans. Instead, you would typically purchase a separate critical illness policy from a different insurer. This means you’ll have two separate insurance policies to manage. However, some insurers might offer bundled packages or partnerships with critical illness providers, making the process smoother.

Source: ffga.com

It’s essential to check with your health insurance provider to see if they have any recommendations or partnerships.

Factors Affecting the Decision

- Your Age and Health: Insurers assess risk based on age and health status. Pre-existing conditions may affect your eligibility or premium rates.

- Your Financial Situation: Can you afford the premiums for both your health insurance and the critical illness policy?

- Your Health Plan’s Coverage: Does your health plan already cover a significant portion of the costs associated with critical illnesses? Adding critical illness insurance might be redundant if your health plan offers extensive coverage.

- The Critical Illness Policy’s Terms: Carefully review the policy’s terms and conditions, including the definition of covered illnesses, waiting periods, and payout amounts.

The Application Process

Applying for a separate critical illness insurance policy typically involves completing an application form, undergoing a medical examination (possibly), and providing information about your health history. The insurer will then assess your application and determine your eligibility and premium rate. This process is similar to applying for any other type of insurance.

Benefits of Combining Critical Illness and Health Insurance

Despite the complexities, combining critical illness insurance with your health plan can offer significant benefits:

- Financial Protection: Critical illness insurance provides a financial safety net that can cover expenses not covered by your health insurance, such as lost income, rehabilitation costs, and long-term care.

- Peace of Mind: Knowing you have a financial cushion in case of a critical illness can alleviate stress and anxiety during a difficult time.

- Flexibility: The lump-sum payout from critical illness insurance can be used for a variety of purposes, giving you flexibility in managing your finances.

Potential Drawbacks

- Increased Premiums: Adding another insurance policy will increase your monthly expenses.

- Redundancy: If your health insurance already offers comprehensive coverage for critical illnesses, adding another policy might be unnecessary.

- Complexity: Managing two separate insurance policies can be more complex than managing just one.

Frequently Asked Questions (FAQs)

- Q: Can I add critical illness insurance to my Medicare plan? A: The ability to add critical illness insurance to a Medicare plan depends on the specific Medicare plan and the critical illness insurer. Some supplemental Medicare plans may offer critical illness coverage as an add-on, while others may not. It’s best to contact your Medicare provider and a critical illness insurance provider for clarification.

- Q: What is the average cost of critical illness insurance? A: The cost of critical illness insurance varies depending on factors such as age, health, coverage amount, and the insurer. It’s advisable to obtain quotes from multiple insurers to compare prices.

- Q: How long is the waiting period for critical illness insurance? A: Waiting periods vary by insurer and policy. This period typically ranges from 30 to 90 days after the policy’s effective date before coverage begins.

- Q: What happens if I’m diagnosed with a critical illness after I’ve canceled my policy? A: If you cancel your policy, you will no longer be covered for critical illnesses. It’s crucial to maintain continuous coverage if you wish to remain protected.

- Q: Are there age limits for critical illness insurance? A: Yes, most insurers have age limits for applying for critical illness insurance. The age limit varies depending on the insurer and the type of policy.

Resources

Call to Action

Adding critical illness insurance to your existing health plan in 2025 is a personal decision that requires careful consideration of your individual circumstances. Contact your health insurance provider and several critical illness insurance providers to discuss your options and obtain personalized quotes. Protecting your financial future during times of unexpected illness is a crucial step in securing your overall well-being.

Don’t hesitate to seek professional financial advice to help you make the best decision for your needs.

Source: bohenhancedbenefits.com

FAQ Guide

What are the typical exclusions in critical illness insurance policies?

Common exclusions can include pre-existing conditions, self-inflicted injuries, and certain high-risk activities. Specific exclusions vary by insurer and policy.

How does critical illness insurance differ from disability insurance?

Critical illness insurance pays a lump sum upon diagnosis of a specified critical illness, while disability insurance provides ongoing income replacement if you become unable to work.

Can I add critical illness insurance if I have a pre-existing condition?

It’s possible, but it may affect your coverage or premiums. Disclosing pre-existing conditions is crucial during the application process.

How much does critical illness insurance typically cost?

Premiums vary widely based on factors like age, health, coverage amount, and the specific policy. Obtaining quotes from multiple insurers is recommended.