Facing a critical illness can be devastating, not just emotionally, but financially. The high costs associated with treatment, lost income, and ongoing care can quickly overwhelm even the most well-prepared individuals. This is where critical illness insurance steps in as a crucial financial safety net. In 2025 and beyond, securing this type of coverage is more important than ever, offering a vital buffer against the unpredictable storms of life.

Understanding Critical Illness Insurance: A Comprehensive Overview

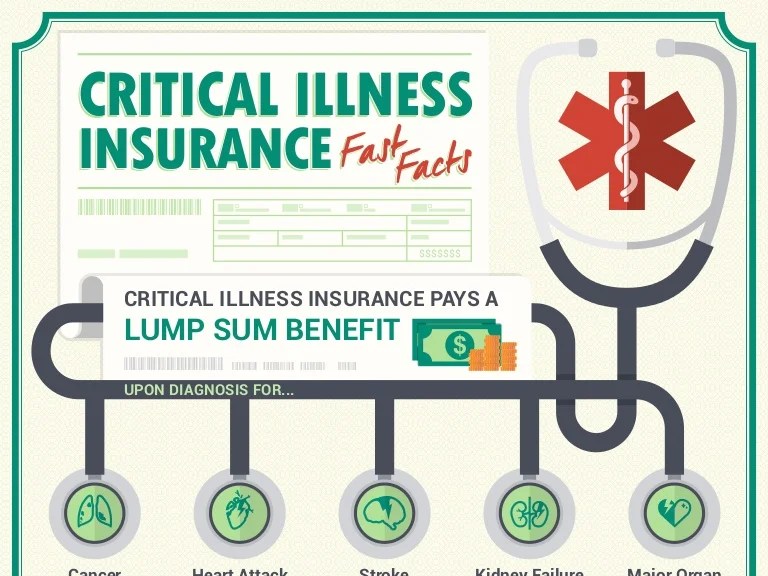

Critical illness insurance is a type of supplemental health insurance that provides a lump-sum payment upon diagnosis of a specified critical illness. Unlike health insurance, which covers medical expenses, critical illness insurance offers financial support to help manage the non-medical costs associated with a serious illness. This financial assistance can be used for a variety of purposes, offering much-needed flexibility during a challenging time.

What Illnesses are Typically Covered?

The specific illnesses covered vary by insurer and policy, but common examples include:

- Cancer

- Heart attack

- Stroke

- Kidney failure

- Multiple sclerosis

- Paralysis

- Major organ transplant

- Alzheimer’s disease

- Parkinson’s disease

It’s crucial to review the policy wording carefully to understand precisely which illnesses are included in your coverage.

How Critical Illness Insurance Benefits Your Finances

The financial benefits of critical illness insurance are multifaceted and significant. Consider these key advantages:

- Covers Treatment Costs: While health insurance covers medical expenses, critical illness insurance can help cover additional costs such as specialized treatments, rehabilitation, and long-term care that may not be fully covered by your health plan.

- Replaces Lost Income: A critical illness can often lead to lost wages due to inability to work. The lump-sum payment can replace this lost income, providing financial stability during recovery.

- Covers Non-Medical Expenses: The financial burden extends beyond medical bills. Critical illness insurance can help cover expenses like home modifications, transportation, childcare, and household help.

- Reduces Financial Stress: The peace of mind knowing you have financial protection during a crisis is invaluable. This reduces stress and allows you to focus on recovery and your family.

- Debt Management: The lump sum payment can be used to pay off existing debts, preventing further financial strain during a difficult period.

Choosing the Right Critical Illness Insurance Policy

Selecting the appropriate critical illness insurance policy requires careful consideration of several factors:

Factors to Consider When Choosing a Policy:

- Coverage Amount: Determine the appropriate lump-sum payout that would adequately cover your potential expenses.

- List of Covered Illnesses: Compare policies to ensure the illnesses you’re most concerned about are included.

- Premium Costs: Balance the level of coverage with the affordability of the premiums. Consider your budget and long-term financial goals.

- Waiting Period: Understand the waiting period before coverage begins after the policy is purchased.

- Policy Exclusions: Review the policy carefully to understand any exclusions or limitations.

- Insurer Reputation: Choose a reputable and financially stable insurance provider.

Critical Illness Insurance vs. Other Health Insurance Options

It’s important to understand how critical illness insurance differs from other health insurance options. It’s not a replacement for health insurance but rather a valuable supplement.

Health Insurance: Covers medical expenses directly related to treatment and care. It typically involves deductibles, co-pays, and out-of-pocket maximums.

Disability Insurance: Provides income replacement if you are unable to work due to illness or injury. It usually pays a monthly benefit, not a lump sum.

Long-Term Care Insurance: Covers the costs of long-term care services, such as nursing homes or assisted living facilities. It is typically purchased separately and focuses on long-term care needs.

Critical illness insurance complements these other forms of insurance, providing a crucial financial safety net that addresses the unique financial challenges associated with a critical illness.

The Increasing Importance of Critical Illness Insurance in 2025

The rising costs of healthcare and the increasing prevalence of chronic illnesses make critical illness insurance increasingly vital in 2025. The financial burden of a critical illness can be catastrophic, potentially leading to debt, financial hardship, and significant stress on families. Having a critical illness insurance policy can mitigate these risks significantly.

Frequently Asked Questions (FAQs)

- Q: How much does critical illness insurance cost? A: The cost varies based on factors such as age, health, coverage amount, and the insurer. It’s best to obtain quotes from multiple insurers to compare pricing.

- Q: Can I get critical illness insurance if I have pre-existing conditions? A: Some insurers may offer coverage, but it might come with higher premiums or exclusions for pre-existing conditions. It’s essential to disclose all relevant health information during the application process.

- Q: What happens if I’m diagnosed with more than one covered illness? A: Most policies will pay out once per illness, but it’s important to check the specific terms of your policy.

- Q: How long does the claim process take? A: The claim process varies by insurer but typically involves submitting medical documentation and completing necessary forms. Allow sufficient time for processing.

- Q: Can I use the payout for anything I want? A: Yes, the lump-sum payment is typically tax-free and can be used for any purpose, providing flexibility during a difficult time.

Conclusion: Securing Your Financial Future

In 2025 and beyond, securing critical illness insurance is a proactive step toward protecting your financial well-being. The unexpected can happen to anyone, and the financial consequences of a critical illness can be devastating. By investing in critical illness insurance, you are investing in your peace of mind and the financial security of your family. Don’t wait until it’s too late.

Contact an insurance professional today to explore your options and find the right policy to meet your needs.

Source: moneyreverie.com

References

While specific policy details vary by insurer, general information on critical illness insurance can be found through reputable financial websites and organizations. It’s always best to consult directly with an insurance professional for personalized advice.

Call to Action

Protect your future. Get a free quote for critical illness insurance today! Click here to learn more and secure your financial well-being.

Essential Questionnaire

What illnesses are typically covered by critical illness insurance?

Coverage varies by policy, but common illnesses include cancer, heart attack, stroke, kidney failure, and major organ transplants. Specific conditions are detailed in the policy document.

Source: slidesharecdn.com

How much coverage should I get?

The ideal coverage amount depends on your individual circumstances, including existing debts, living expenses, and potential medical costs. Consult a financial advisor to determine the appropriate level of coverage for your needs.

Can I get critical illness insurance if I have pre-existing conditions?

Insurers assess applications individually. Pre-existing conditions may affect eligibility or premiums. It’s essential to disclose all relevant health information accurately.

How much does critical illness insurance cost?

Premiums vary based on factors such as age, health status, coverage amount, and the insurer. Obtaining quotes from multiple insurers allows for comparison and selection of the most suitable plan.