The landscape of critical illness insurance is undergoing a significant transformation in 2025 and beyond. Driven by advancements in medical technology, evolving societal needs, and increased consumer awareness, insurers are expanding coverage options and refining their offerings to better meet the diverse needs of policyholders. This article delves into the key changes shaping the critical illness insurance market, exploring new coverage options, enhanced benefits, and the implications for consumers.

Expanding Definitions of “Critical Illness”

Traditionally, critical illness insurance policies covered a limited range of severe conditions, primarily focusing on cancer, heart attack, and stroke. However, 2025 witnesses a broader definition of “critical illness,” encompassing a wider spectrum of debilitating diseases. This expansion reflects advancements in medical understanding and the increasing prevalence of conditions like:

Source: org.uk

- Alzheimer’s Disease and other Dementias: Recognizing the devastating impact of these neurodegenerative diseases, many insurers are now including them in their critical illness coverage, offering financial support for long-term care and related expenses.

- Multiple Sclerosis (MS) and Parkinson’s Disease: These chronic neurological conditions often require extensive and costly treatments, making insurance coverage increasingly vital. Inclusion in critical illness policies provides crucial financial assistance.

- Specific Types of Cancer: Policies are moving beyond broad cancer coverage to include specific cancer types with varying levels of severity and treatment needs, offering more tailored benefits.

- Organ Failure (Kidney, Liver, etc.): Coverage is expanding to include organ failure, addressing the significant financial burden associated with dialysis, transplants, and ongoing care.

- Severe Burns and Traumatic Brain Injuries: These life-altering events often necessitate extensive rehabilitation and ongoing medical care, highlighting the importance of comprehensive coverage.

Increased Focus on Early-Stage Diagnosis

A notable trend is the inclusion of coverage for early-stage diagnoses of critical illnesses. This proactive approach aims to provide financial support for timely and effective treatment, potentially improving patient outcomes and reducing long-term healthcare costs. Early intervention often leads to better treatment success, and insurance coverage can help alleviate the financial stress associated with early diagnosis and treatment.

Enhanced Benefits and Added Features

Beyond expanding the definition of covered illnesses, insurers are also enhancing the benefits offered under critical illness policies. These improvements aim to provide more comprehensive financial support and address the holistic needs of policyholders.

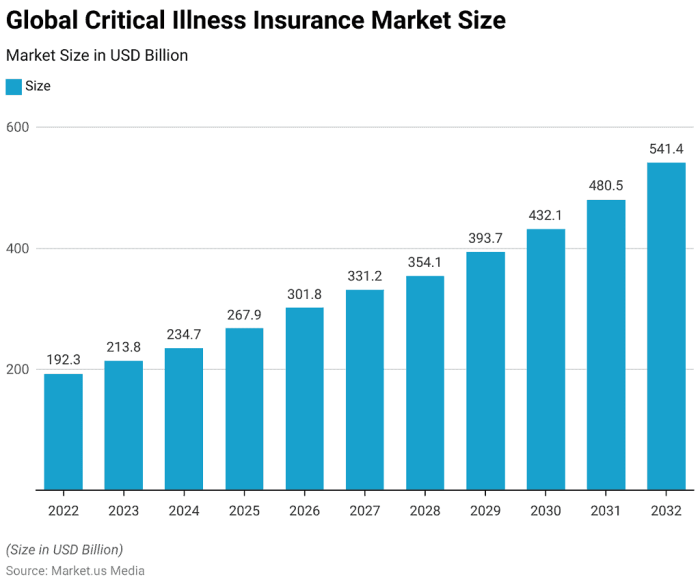

Source: market.us

- Increased Lump-Sum Payouts: Many insurers are increasing the lump-sum payouts for covered illnesses, recognizing the rising costs of healthcare and rehabilitation.

- Coverage for Alternative Therapies: There’s a growing trend towards including coverage for alternative therapies, such as acupuncture, physiotherapy, and certain types of nutritional therapy, reflecting a broader approach to healthcare.

- Waiver of Premium Benefit Enhancements: Policies are increasingly offering more robust waiver of premium benefits, ensuring continued coverage even if the policyholder becomes unable to work due to their illness.

- Mental Health Support: Recognizing the significant mental health challenges associated with critical illnesses, some insurers are incorporating mental health support services, such as counseling and therapy, into their policies.

- Return to Work Support: Policies are increasingly incorporating features to support policyholders’ return to work, such as vocational rehabilitation services and financial assistance during the transition.

Technological Advancements and Personalized Coverage

Technology is playing a significant role in shaping the future of critical illness insurance. Insurers are leveraging data analytics and AI to better assess risk, personalize coverage options, and offer more competitive premiums. This includes:

- Telemedicine Integration: Integrating telemedicine into policies can offer convenient and cost-effective access to medical consultations and monitoring, improving both access and affordability.

- Wearable Technology Integration: Data from wearable fitness trackers can be used to assess lifestyle factors and potentially offer personalized premiums based on health and wellness behaviors.

- Personalized Risk Assessment: Advanced algorithms can analyze individual health data to provide more accurate risk assessments and tailor coverage to specific needs.

New Coverage Options: Beyond the Traditional Lump Sum

The traditional lump-sum payout is being complemented by more innovative coverage options, offering greater flexibility and tailored support:

- Income Replacement Benefits: These benefits provide a regular income stream to replace lost earnings during treatment and recovery, offering a crucial safety net for policyholders.

- Critical Illness Concierge Services: Some insurers are offering concierge services to assist with navigating the complexities of treatment, providing support with appointments, medical bills, and other administrative tasks.

- Chronic Illness Coverage Riders: These riders provide ongoing financial support for managing chronic illnesses that may not qualify as “critical” but still impose significant financial burdens.

- Children’s Critical Illness Coverage: Specific policies are designed to cover children diagnosed with critical illnesses, addressing the unique financial challenges faced by families.

Choosing the Right Critical Illness Insurance Policy in 2025

With the evolving landscape of critical illness insurance, selecting the right policy requires careful consideration of individual needs and circumstances. Factors to consider include:

- Definition of Covered Illnesses: Carefully review the specific illnesses covered by the policy, ensuring it aligns with your individual risk profile.

- Benefit Amounts: Determine the appropriate benefit amount to cover potential medical expenses, lost income, and other related costs.

- Premium Costs: Compare premiums from different insurers to find a policy that fits your budget.

- Policy Exclusions and Limitations: Understand any exclusions or limitations of the policy before making a decision.

- Insurer Reputation and Financial Stability: Choose a reputable insurer with a strong financial standing to ensure the long-term security of your policy.

Frequently Asked Questions (FAQ)

- Q: What is critical illness insurance? A: Critical illness insurance provides a lump sum or other benefits upon diagnosis of a specified serious illness.

- Q: What illnesses are typically covered? A: Traditional coverage includes cancer, heart attack, and stroke, but coverage is expanding to include Alzheimer’s, Parkinson’s, MS, and other conditions.

- Q: How much does critical illness insurance cost? A: Premiums vary based on age, health status, coverage amount, and the insurer.

- Q: Can I get critical illness insurance if I have a pre-existing condition? A: It may be more difficult or more expensive, but some insurers offer coverage with certain pre-existing conditions.

- Q: What are the benefits of critical illness insurance? A: It provides financial security to cover medical expenses, lost income, and other costs associated with a critical illness.

References

While specific insurer websites change frequently, general information on critical illness insurance can be found through reputable financial websites and consumer protection agencies. Searching for terms like “critical illness insurance comparison,” “best critical illness insurance providers,” or consulting with a financial advisor can provide valuable information.

Call to Action

Don’t wait until it’s too late. Contact a qualified insurance advisor today to discuss your critical illness insurance needs and explore the latest coverage options available in 2025. Protecting your financial future and your family’s well-being is an investment worth making.

User Queries

What specific illnesses are typically covered under these new options?

Coverage varies by insurer, but expect expansions beyond traditional heart conditions and cancers to include conditions like Alzheimer’s, Parkinson’s, and multiple sclerosis.

How will these changes affect premiums?

The impact on premiums is complex and depends on factors like age, health status, and the specific policy. While some new options might offer more comprehensive coverage at similar or slightly higher costs, others may provide more affordable entry points.

Are there new ways to pay for critical illness insurance in 2025?

Yes, expect to see more flexible payment options, such as shorter-term plans, pay-as-you-go options, or options to adjust coverage levels more easily.

How can I find the best critical illness insurance plan for my needs?

Compare quotes from multiple insurers, carefully review policy details, and consider consulting a financial advisor specializing in insurance to determine the most suitable plan based on your individual circumstances and risk tolerance.