Facing a critical illness can be devastating, not just physically but also financially. The high costs of treatment, rehabilitation, and lost income can quickly overwhelm even the most well-prepared individuals. This is where critical illness insurance (CI) plays a vital role, offering a financial safety net during these challenging times. Choosing the right plan, however, can be complex.

This comprehensive guide will help you navigate the intricacies of critical illness insurance and select a plan that best suits your needs in 2025 and beyond.

Understanding Critical Illness Insurance

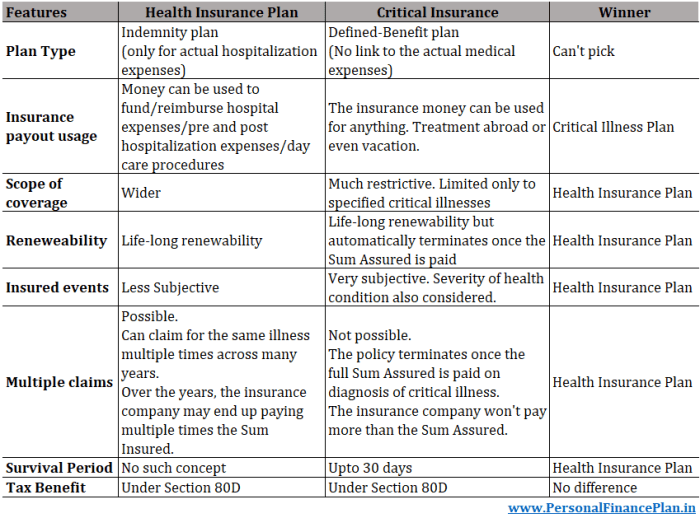

Critical illness insurance provides a lump-sum payout upon diagnosis of a specified critical illness. This payout can be used to cover medical expenses, lost income, or other related costs. Unlike health insurance, which covers ongoing medical treatments, CI insurance provides a one-time payment to help you manage the financial burden of a serious illness. The specific illnesses covered vary by policy, but typically include conditions like cancer, heart attack, stroke, kidney failure, and major organ transplants.

Some policies may also cover less common but equally devastating illnesses.

Key Features to Consider

- Covered Illnesses: Carefully review the list of covered illnesses. Some policies offer broader coverage than others. Look for plans that cover a wide range of critical illnesses, including those with a higher chance of occurring.

- Payout Amount: The payout amount is crucial. Consider your potential medical expenses, lost income, and other financial obligations when determining the appropriate coverage amount. Remember to factor in potential inflation over the policy’s duration.

- Waiting Period: This is the period after the policy’s commencement before the coverage becomes effective. Shorter waiting periods are generally preferred, but they might come with higher premiums.

- Premium Costs: Premiums vary depending on factors like age, health status, coverage amount, and the insurer. Compare premiums from different insurers to find the most cost-effective option without compromising on coverage.

- Renewal Options: Understand the policy’s renewal terms. Some policies are renewable up to a certain age, while others might have limitations. Guaranteed renewability is a desirable feature.

- Claim Process: A straightforward and transparent claim process is essential. Inquire about the required documentation, processing time, and any potential challenges you might encounter.

- Insurer’s Financial Stability: Choose a reputable and financially stable insurer to ensure your claim will be paid when needed. Check the insurer’s ratings from independent agencies.

Factors Influencing Your Choice

Several factors should guide your decision when selecting a critical illness insurance plan:

Your Age and Health

Your age and health status significantly impact the premium costs. Younger, healthier individuals generally qualify for lower premiums. Pre-existing conditions may affect your eligibility or increase your premiums. It’s crucial to be transparent about your health history when applying.

Your Financial Situation

Assess your current financial situation and future financial goals. Determine how much coverage you need to adequately protect yourself and your family from the financial burden of a critical illness. Consider your income, savings, and existing insurance coverage.

Your Family History

A family history of critical illnesses can influence your risk assessment. If you have a family history of cancer, heart disease, or other critical illnesses, you might consider higher coverage amounts.

Your Lifestyle

Your lifestyle choices, such as diet, exercise, and smoking habits, can affect your premiums. A healthier lifestyle can often lead to lower premiums.

Types of Critical Illness Insurance Plans

Several types of critical illness insurance plans are available, each with its own features and benefits:

Individual Plans

These plans are tailored to individual needs and offer greater flexibility in terms of coverage and premiums. They provide personalized protection.

Group Plans

Offered through employers or associations, group plans usually offer lower premiums due to economies of scale. However, coverage options might be more limited compared to individual plans.

Comparing Critical Illness Insurance Plans

Before making a decision, compare several plans from different insurers. Use online comparison tools or consult with an independent insurance advisor to ensure you are getting the best value for your money. Pay close attention to the policy wording and ensure you understand all the terms and conditions.

Frequently Asked Questions (FAQs)

- Q: How much critical illness insurance do I need? A: The amount of coverage depends on your individual circumstances, including your income, expenses, and potential medical costs. It’s advisable to consult with a financial advisor to determine the appropriate coverage amount.

- Q: What illnesses are typically covered? A: Commonly covered illnesses include cancer, heart attack, stroke, kidney failure, and major organ transplants. Specific illnesses covered vary by policy, so it’s crucial to review the policy document carefully.

- Q: Can I get critical illness insurance if I have a pre-existing condition? A: It’s possible, but it might affect your eligibility or increase your premiums. Disclosure of pre-existing conditions is crucial during the application process.

- Q: How long is the waiting period? A: The waiting period varies depending on the insurer and the policy. It’s usually between 30 and 90 days.

- Q: What happens if I am diagnosed with multiple critical illnesses? A: Some policies offer a payout for each covered illness, while others might have limitations. Review the policy wording for details.

- Q: Can I claim if I am diagnosed with a critical illness but don’t require treatment? A: This depends on the policy’s terms and conditions. Some policies might still provide a payout, while others may require evidence of treatment.

Resources

Call to Action

Don’t wait until it’s too late. Protect yourself and your family from the devastating financial impact of a critical illness. Contact an insurance professional today to discuss your options and find the best critical illness insurance plan for your individual needs in 2025.

FAQs

What is the difference between critical illness insurance and health insurance?

Source: personalfinanceplan.in

Health insurance covers medical expenses, while critical illness insurance provides a lump-sum payment upon diagnosis of a specified critical illness, regardless of medical expenses.

How long does it take to receive a payout after a claim?

The processing time varies by insurer, but typically ranges from a few weeks to a few months, depending on the complexity of the claim.

Can I increase my coverage amount later?

Some policies allow for increasing coverage, but this may involve a medical review and higher premiums.

What happens if I develop a critical illness after the policy expires?

Coverage ends upon policy expiration. You would need to secure a new policy if you wish to maintain coverage.

Are pre-existing conditions covered?

Source: trendceylon.com

Pre-existing conditions are typically excluded, though some insurers may offer limited coverage after a waiting period.