Navigating the world of critical illness insurance can be challenging, especially for seniors. As we age, the risk of developing serious health conditions increases, making comprehensive coverage more crucial than ever. This detailed guide explores the best critical illness insurance plans available for seniors in 2025, considering factors like affordability, coverage, and specific needs. We’ll delve into the nuances of policy features, helping you make an informed decision to protect your financial well-being during a critical illness.

Understanding Critical Illness Insurance for Seniors

Critical illness insurance provides a lump-sum payout upon diagnosis of a specified critical illness, such as cancer, heart attack, stroke, or kidney failure. This payout can significantly alleviate the financial burden associated with medical expenses, lost income, and ongoing care. For seniors, this financial safety net is particularly vital, as medical costs tend to be higher in later life and savings may be limited.

Unlike health insurance, which covers medical bills, critical illness insurance offers a direct cash payment that can be used for any purpose, providing greater flexibility.

Key Considerations for Seniors Choosing Critical Illness Insurance

- Pre-existing Conditions: Many insurers have exclusions or limitations for pre-existing conditions. It’s crucial to disclose all relevant health information accurately during the application process. Failing to do so can lead to claim denials.

- Affordability: Premiums for critical illness insurance increase with age and health status. Seniors should carefully consider their budget and choose a plan that aligns with their financial capabilities. Consider comparing quotes from multiple insurers.

- Coverage Amount: The payout amount should be sufficient to cover anticipated medical expenses, lost income, and ongoing care costs. Factor in potential inflation and the increasing cost of healthcare.

- Definition of Critical Illnesses: Policies vary in their definition of critical illnesses. Some may offer broader coverage than others, including less common conditions. Carefully review the policy document to understand what illnesses are covered.

- Waiting Periods: Most policies have waiting periods before coverage begins. This is the time between policy activation and when a claim can be filed for a specific illness. Understand these waiting periods before committing to a plan.

- Renewal Options: Determine whether the policy is guaranteed renewable or if the insurer can increase premiums or cancel the policy in the future. Guaranteed renewable options offer greater peace of mind.

Types of Critical Illness Insurance Plans for Seniors

Several types of critical illness insurance plans cater to the specific needs of seniors. These include:

Individual Critical Illness Insurance

Individual plans offer personalized coverage tailored to the individual’s health status and needs. They typically provide more flexibility in terms of coverage amount and benefits, but premiums can be higher compared to group plans.

Group Critical Illness Insurance

Group plans are often offered through employers or associations. While premiums might be lower than individual plans, coverage options are usually more limited. Eligibility may also depend on the group’s criteria.

Combined Critical Illness and Life Insurance

Some insurers offer combined policies that include both critical illness and life insurance coverage. This provides comprehensive protection for both critical illnesses and death, offering a cost-effective solution for those seeking broader coverage.

Finding the Best Plan for Your Needs

Choosing the right critical illness insurance plan requires careful consideration of your individual circumstances and financial goals. Here are some steps to help you find the best fit:

- Assess your needs: Determine the level of coverage you require based on your health status, financial situation, and potential medical expenses.

- Compare quotes: Obtain quotes from multiple insurers to compare premiums, coverage options, and policy features.

- Read the policy documents carefully: Understand the terms and conditions, including exclusions, waiting periods, and claim procedures.

- Seek professional advice: Consult with a financial advisor or insurance broker to get personalized recommendations based on your specific needs.

Frequently Asked Questions (FAQ)

Q: Can I get critical illness insurance if I have pre-existing conditions?

A: Yes, but it may be more challenging to secure coverage, and you might face higher premiums or exclusions for your pre-existing conditions. Full disclosure is crucial during the application process.

Q: How much coverage do I need?

Source: moneyreverie.com

A: The ideal coverage amount depends on your individual circumstances, including anticipated medical expenses, lost income, and rehabilitation costs. It’s advisable to consult with a financial advisor to determine the appropriate coverage level.

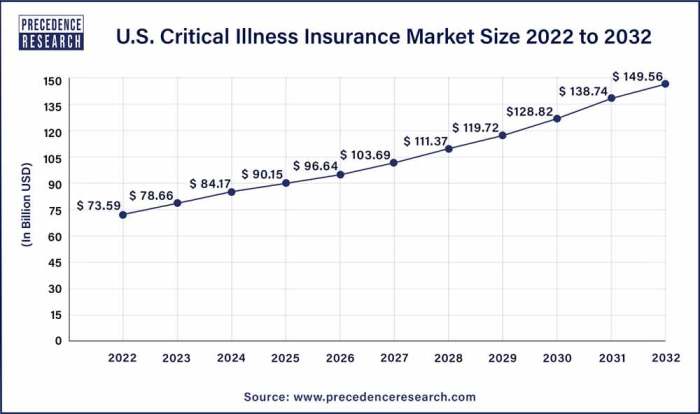

Source: precedenceresearch.com

Q: What happens if I don’t make my premium payments?

A: Failure to make premium payments can lead to policy lapse, meaning your coverage will be terminated. It’s important to maintain consistent payments to ensure continuous coverage.

Q: How long is the waiting period?

A: Waiting periods vary depending on the insurer and the specific illness. It’s crucial to review the policy document to understand the waiting period for each covered illness.

Q: Can I change my policy later?

A: Policy changes are possible, but they often depend on the insurer’s terms and conditions. You may need to reapply or undergo a new medical assessment.

Resources

- Investopedia: Critical Illness Insurance

- Insurance Information Institute: Critical Illness Insurance

- (Add other relevant links to reputable insurance comparison websites or government resources)

Conclusion

Securing critical illness insurance is a vital step in planning for your financial future, especially as you age. By carefully considering your needs, comparing plans, and seeking professional advice, you can find the best critical illness insurance plan to provide you with peace of mind and financial security during challenging times. Don’t delay – protect yourself and your loved ones today.

Call to Action (CTA)

Ready to explore your critical illness insurance options? Contact us today for a free consultation and personalized quote. We’ll help you navigate the complexities of insurance and find the perfect plan to fit your needs and budget.

Question Bank

What is a critical illness?

A critical illness is a serious health condition, such as heart attack, stroke, or cancer, that significantly impacts your health and ability to work.

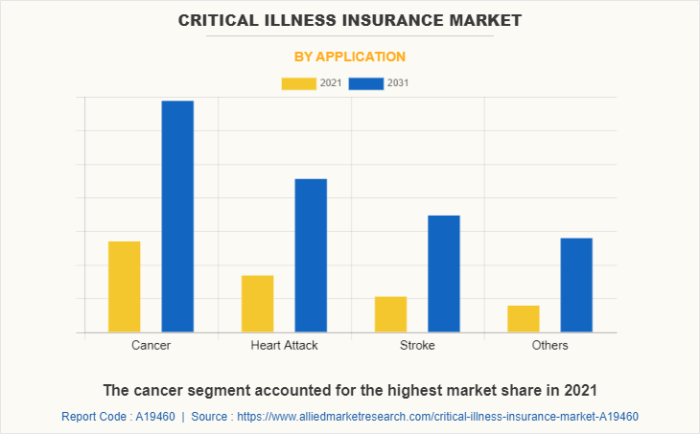

Source: alliedmarketresearch.com

How much coverage do I need?

The amount of coverage depends on your individual circumstances, including medical expenses and potential lost income. Consult an insurance professional for personalized advice.

What are the common exclusions in critical illness insurance plans?

Common exclusions can vary between plans but may include pre-existing conditions, self-inflicted injuries, or certain types of illnesses. Carefully review the policy details.

Can I still get coverage if I have pre-existing conditions?

Some plans may offer coverage for pre-existing conditions, but this often comes with higher premiums or limitations. Disclosure of pre-existing conditions is crucial.

When should I start looking for critical illness insurance?

It’s advisable to start considering critical illness insurance as early as possible, ideally before you reach your senior years, to secure more favorable rates and broader coverage options.