Critical illness insurance provides a vital financial safety net in the face of life-altering diagnoses. As we look ahead to 2025, understanding the projected costs and factors influencing premiums is crucial for informed decision-making. This comprehensive guide explores the anticipated cost of critical illness insurance in 2025, examining various influencing factors and providing insights to help you navigate this important financial planning aspect.

Factors Influencing Critical Illness Insurance Premiums in 2025

Several key factors will shape the cost of critical illness insurance in 2025. These factors interact in complex ways, resulting in a wide range of premium possibilities depending on individual circumstances.

Age and Health

Age remains a dominant factor. Younger individuals generally enjoy lower premiums due to a statistically lower risk of developing critical illnesses. Pre-existing health conditions, family history of critical illnesses, and current lifestyle choices (smoking, diet, exercise) significantly impact premium calculations. Insurers assess risk profiles meticulously, leading to higher premiums for those deemed higher risk.

Source: slidesharecdn.com

Type and Level of Cover

The extent of coverage directly impacts the cost. Policies offering broader coverage for a wider range of critical illnesses naturally command higher premiums than those with more limited definitions. Similarly, higher payout amounts result in increased premiums. Consider the specific critical illnesses covered – some policies might exclude certain conditions or offer varying payout levels depending on the severity of the illness.

Source: cornerstoneins.ca

Policy Term and Payment Frequency

The length of the policy term influences the overall cost. Longer-term policies spread the cost over a longer period but typically result in higher total premiums compared to shorter-term options. Payment frequency also plays a role; annual payments often lead to slightly lower premiums than monthly or quarterly payments due to administrative costs.

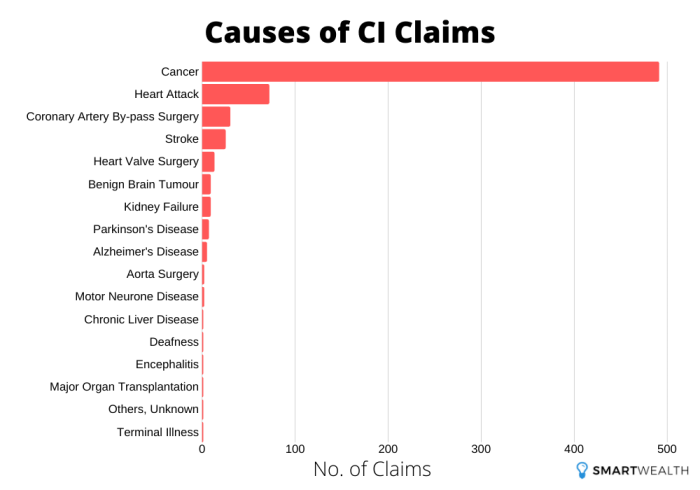

Source: smartwealth.sg

Insurer and Policy Features

Different insurers employ different underwriting practices and risk assessment models, leading to variations in premium pricing. Additional policy features, such as waiver of premium benefits (coverage continues even if you can’t pay premiums due to illness) or accelerated death benefits, will increase the overall cost. It’s crucial to compare quotes from multiple insurers to find the best value.

Inflation and Economic Conditions

The general economic climate and inflation rates significantly influence insurance costs. Rising healthcare costs and increased claims payouts drive up premiums. Economic uncertainty and inflationary pressures often translate into higher insurance premiums across the board.

Technological Advancements in Healthcare

Advancements in medical technology and treatments impact the cost of critical illness insurance. While improved treatments offer better outcomes, they also contribute to increased claim costs, potentially influencing future premium adjustments. Insurers continuously assess these advancements and adjust their risk models accordingly.

Predicting the Cost in 2025: A Range of Possibilities

Precisely predicting the cost of critical illness insurance in 2025 is challenging due to the interplay of the factors discussed above. However, we can anticipate a range of possibilities. Based on current trends and projections, premiums are likely to increase, although the extent of the increase will vary depending on individual circumstances. For a healthy, young individual, a modest increase might be expected.

However, individuals with pre-existing conditions or seeking extensive coverage could face more substantial premium increases.

Tips for Managing the Cost of Critical Illness Insurance

Several strategies can help manage the cost of critical illness insurance:

- Compare quotes from multiple insurers: Don’t settle for the first quote you receive. Shop around and compare policies from different insurers to find the best value.

- Consider a shorter policy term: Shorter-term policies generally have lower premiums than longer-term options, although the total cost might be higher.

- Opt for a higher deductible: A higher deductible will typically lower your premiums, but you’ll need to be prepared to pay more out-of-pocket in case of a claim.

- Maintain a healthy lifestyle: A healthy lifestyle can improve your chances of securing lower premiums.

- Review your coverage needs regularly: As your circumstances change, review your coverage needs and adjust your policy accordingly.

Frequently Asked Questions (FAQ)

- Q: What is critical illness insurance? A: Critical illness insurance provides a lump-sum payout if you’re diagnosed with a specified critical illness, such as cancer, heart attack, or stroke. This money can help cover medical expenses, lost income, and other related costs.

- Q: How much critical illness insurance do I need? A: The amount of coverage you need depends on your individual circumstances, including your age, health, income, and financial obligations. It’s recommended to consult a financial advisor to determine the appropriate level of coverage.

- Q: Can I get critical illness insurance if I have a pre-existing condition? A: It might be more challenging to secure coverage or you may receive higher premiums, but some insurers offer policies to individuals with pre-existing conditions. Full disclosure is essential during the application process.

- Q: When should I buy critical illness insurance? A: It’s best to secure critical illness insurance while you are young and healthy to secure lower premiums. However, it’s never too late to consider this essential protection.

- Q: What are the common critical illnesses covered? A: Common critical illnesses covered typically include cancer, heart attack, stroke, kidney failure, and major organ transplants. The specific illnesses covered vary depending on the insurer and policy.

Resources

- NHS – Critical Illness Insurance (UK based, but provides general information)

- (Add links to reputable insurance comparison websites relevant to your target audience’s location)

- (Add links to reputable financial planning websites relevant to your target audience’s location)

Call to Action

Don’t wait until it’s too late. Secure your financial future and protect your loved ones by exploring critical illness insurance options today. Contact a qualified financial advisor or insurance broker to discuss your specific needs and obtain personalized quotes. Take control of your financial well-being and prepare for unforeseen circumstances.

General Inquiries

What factors influence the cost of critical illness insurance?

Several factors influence premiums, including age, health status, chosen coverage amount, policy benefits (e.g., specific illnesses covered), and the insurer.

Can I get critical illness insurance if I have pre-existing conditions?

Insurers assess pre-existing conditions. Coverage might be offered but could involve higher premiums or exclusions for specific conditions. Disclosure is essential.

How often are critical illness insurance premiums reviewed?

Premium review frequency varies by insurer and policy type. Some policies have fixed premiums for a set period, while others may adjust periodically based on factors like age and claims experience.

What is the difference between critical illness insurance and life insurance?

Critical illness insurance pays out a lump sum upon diagnosis of a specified critical illness, while life insurance pays a death benefit to beneficiaries upon the insured’s death.