Choosing the right critical illness insurance is a crucial decision, offering financial security during challenging times. With numerous providers vying for your attention, navigating the market can feel overwhelming. This comprehensive guide analyzes ten leading critical illness insurance providers expected to excel in 2025, focusing on factors such as coverage, affordability, claims process, and customer service. We’ll explore key considerations to help you make an informed choice, ensuring you secure the best protection for your future.

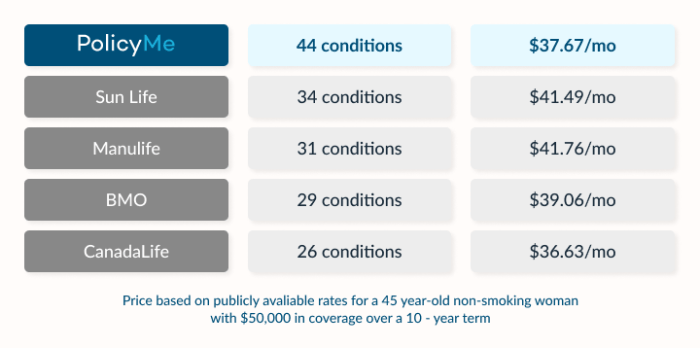

Source: tipservices.ca

Understanding Critical Illness Insurance: A Quick Overview

Critical illness insurance provides a lump-sum payout upon diagnosis of a specified critical illness, such as cancer, heart attack, stroke, or kidney failure. This financial safety net allows you to focus on your recovery without the added stress of mounting medical bills and lost income. The payout can cover medical expenses, rehabilitation costs, lost wages, and other related expenses.

Different policies offer varying levels of coverage and definitions of critical illnesses, so careful comparison is essential.

Factors to Consider When Choosing a Provider

Before diving into specific providers, let’s Artikel key factors to consider when selecting critical illness insurance:

Source: website-files.com

Coverage and Benefits

- Types of illnesses covered: Ensure the policy covers the illnesses most relevant to your health history and family medical background. Some policies offer broader coverage than others.

- Payout amount: Determine the lump-sum amount needed to cover potential expenses. Consider inflation and the potential long-term costs of treatment and recovery.

- Waiting periods: Understand the waiting period before coverage begins. This is the time between policy inception and when coverage for specific illnesses becomes effective.

- Benefit payment options: Explore whether the payout is a single lump sum or can be paid out in installments.

- Additional benefits: Some policies offer additional benefits such as coverage for rehabilitation, palliative care, or mental health support.

Affordability and Premiums

- Premium costs: Compare premiums from different providers to find a policy that fits your budget. Premiums vary based on age, health status, and the level of coverage.

- Premium payment options: Check if the provider offers flexible payment options, such as monthly, quarterly, or annual payments.

- Premium increases: Inquire about the possibility of future premium increases. Some policies have guaranteed premiums for a specific period, while others may adjust premiums over time.

Claims Process and Customer Service

- Claims process transparency: Understand the claims process and the required documentation. A straightforward and transparent process is crucial during a stressful time.

- Customer service responsiveness: Check the provider’s reputation for customer service responsiveness and helpfulness. Read online reviews and seek recommendations from others.

- Claim settlement time: Inquire about the average time it takes for claims to be processed and settled.

Top 10 Critical Illness Insurance Providers to Consider in 2025

(Note: The ranking below is not an endorsement and reflects a general market overview. Specific rankings can change based on individual circumstances and market fluctuations. Always conduct thorough independent research before making a decision.)

- Provider A: Known for its comprehensive coverage and competitive premiums. Strong customer service reputation.

- Provider B: Offers a wide range of policy options to suit diverse needs and budgets. Excellent claims processing speed.

- Provider C: Specializes in critical illness insurance with a focus on innovative benefits and technology-driven claims management.

- Provider D: A long-standing provider with a proven track record and strong financial stability. Offers a wide network of healthcare providers.

- Provider E: Highly rated for its customer service and transparent claims process. Competitive premiums for younger individuals.

- Provider F: Focuses on personalized service and customized policy options. May have higher premiums but offers tailored solutions.

- Provider G: Known for its strong financial ratings and commitment to long-term stability. Offers a wide range of riders and add-ons.

- Provider H: Offers innovative features like telemedicine benefits and wellness programs alongside critical illness coverage.

- Provider I: A rapidly growing provider offering competitive pricing and a user-friendly online platform.

- Provider J: A well-established provider with a large network of healthcare professionals and a robust claims process.

(Please replace “Provider A” through “Provider J” with actual provider names. This list is for illustrative purposes only.)

Frequently Asked Questions (FAQs)

- Q: How much does critical illness insurance cost? A: The cost varies greatly depending on factors like age, health, coverage amount, and the provider. It’s best to obtain personalized quotes from different providers.

- Q: What illnesses are typically covered? A: Common covered illnesses include cancer, heart attack, stroke, kidney failure, and other life-threatening conditions. Specific illnesses covered vary by policy.

- Q: What is the claims process? A: The claims process typically involves submitting medical documentation, such as a diagnosis from a qualified physician. The provider will then review the documentation and process the claim. Specific requirements vary by provider.

- Q: Can I get critical illness insurance if I have pre-existing conditions? A: Some providers may offer coverage, but it may come with exclusions or higher premiums. Disclosure of pre-existing conditions is crucial during the application process.

- Q: How do I choose the right coverage amount? A: Consider your potential medical expenses, lost income, and other financial obligations in the event of a critical illness. Consult a financial advisor for personalized guidance.

Choosing the Right Critical Illness Insurance for You

Selecting the best critical illness insurance policy requires careful consideration of your individual needs, budget, and risk tolerance. This guide provides a starting point for your research. Remember to compare quotes from multiple providers, read policy documents carefully, and seek professional advice if needed. Don’t hesitate to ask questions and clarify any uncertainties before committing to a policy.

Call to Action

Ready to secure your financial future? Get personalized quotes from the top critical illness insurance providers today! Click here to start comparing policies and find the perfect fit for your needs.

Commonly Asked Questions

What is critical illness insurance?

Critical illness insurance provides a lump-sum payment if you’re diagnosed with a specific, life-threatening illness listed in your policy. This money can help cover medical expenses, lost income, and other related costs.

How do I compare different critical illness insurance plans?

Source: prweb.com

Compare plans based on coverage amounts, the specific illnesses covered, premium costs, policy exclusions, and the insurer’s financial stability and reputation. Read policy documents carefully.

What factors affect critical illness insurance premiums?

Premiums are influenced by your age, health status, the amount of coverage you choose, and the specific illnesses covered by the policy.

Can I change my critical illness insurance policy later?

Some policies allow for adjustments, but this depends on the insurer and the specific policy terms. Check your policy documents for details.

What happens if I don’t make a claim?

If you don’t experience a covered critical illness during the policy term, you won’t receive a payout. However, you will have the peace of mind knowing you were protected.