Critical illness insurance is a valuable safety net in an increasingly unpredictable world. It provides a lump-sum payout upon diagnosis of a specified critical illness, offering financial relief during a time of significant medical expenses and potential loss of income. This comprehensive guide will explore the intricacies of critical illness insurance, its benefits, and what you need to consider in 2025 and beyond.

What is Critical Illness Insurance?

Critical illness insurance is a type of health insurance policy that pays out a predetermined sum of money if you are diagnosed with a specified critical illness listed in your policy. Unlike health insurance, which covers medical expenses, critical illness insurance provides a cash benefit to help manage the financial burden associated with a serious illness. This financial assistance can cover various expenses, including medical bills, lost income, rehabilitation costs, and ongoing care.

Key Features of Critical Illness Insurance

- Lump-Sum Payment: Upon diagnosis of a covered critical illness, you receive a lump-sum payment, providing immediate financial relief.

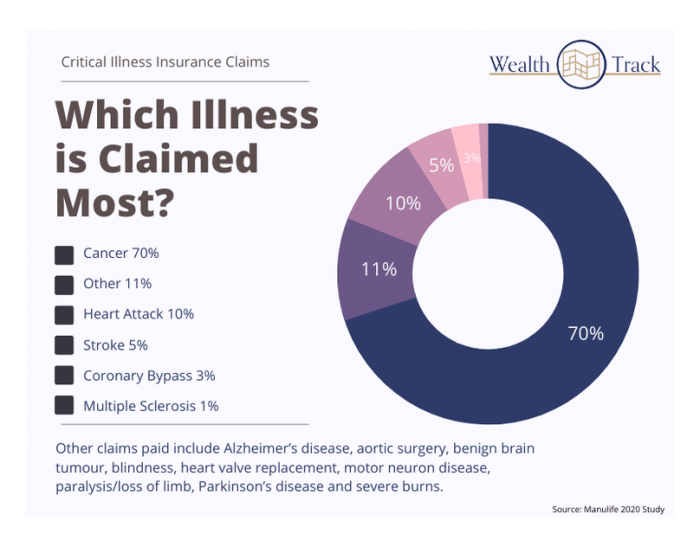

- Specified Critical Illnesses: Policies typically cover a range of serious illnesses, such as cancer, heart attack, stroke, kidney failure, and major organ transplants. The specific illnesses covered vary by policy, so careful review is crucial.

- Diagnosis-Based Coverage: The payout is triggered by the diagnosis of the illness, not necessarily the treatment or outcome.

- Flexibility in Use: The lump-sum payment can be used for any purpose, offering flexibility to address your unique financial needs.

- Supplemental Coverage: It often acts as a supplement to existing health insurance, not a replacement.

Benefits of Critical Illness Insurance in 2025

The benefits of critical illness insurance extend beyond simply covering medical bills. In 2025, with rising healthcare costs and the increasing prevalence of chronic diseases, its importance is amplified.

Financial Security During Treatment

Critical illnesses often require extensive and costly medical treatments, including surgery, chemotherapy, radiation therapy, and long-term rehabilitation. Critical illness insurance can significantly alleviate the financial strain, allowing you to focus on your recovery rather than worrying about mounting medical bills. This is especially important given the projected increase in healthcare costs in the coming years.

Income Replacement

Many critical illnesses result in lost income due to disability or the inability to work. The lump-sum payment from critical illness insurance can help replace lost wages, ensuring financial stability during a period of reduced earning capacity. This is particularly crucial for self-employed individuals or those without robust sick leave benefits.

Debt Management

Facing a critical illness can exacerbate existing financial burdens. The insurance payout can be used to manage or eliminate debt, reducing financial stress during a challenging time. This can prevent further complications and allow for a smoother recovery process.

Source: topfinancialresources.com

Family Support

A critical illness impacts not only the individual but also their family. The financial support provided by critical illness insurance can help families cope with the emotional and financial challenges, ensuring their well-being during a difficult period. This includes covering childcare expenses, mortgage payments, and other essential household costs.

Peace of Mind

Perhaps the most significant benefit is the peace of mind it provides. Knowing you have a financial safety net in place can reduce stress and anxiety associated with the possibility of a critical illness, allowing you to focus on your health and well-being.

Choosing the Right Critical Illness Insurance Policy

Selecting the right critical illness insurance policy requires careful consideration of several factors:

Coverage Amount

Determine the appropriate coverage amount based on your individual circumstances, including medical expenses, potential loss of income, and existing financial obligations. Consider consulting a financial advisor to determine the suitable level of coverage.

Source: medium.com

Covered Illnesses

Compare policies to ensure they cover the critical illnesses most relevant to your health history and risk factors. Some policies offer more comprehensive coverage than others.

Waiting Periods

Understand the waiting period before coverage begins. This period typically ranges from 30 to 90 days. Policies with shorter waiting periods offer faster access to benefits.

Premium Costs

Balance the level of coverage with the affordability of premiums. Consider your budget and financial capabilities when selecting a policy.

Insurer Reputation

Choose a reputable and financially stable insurance provider with a proven track record of paying claims promptly and efficiently.

Frequently Asked Questions (FAQs)

- Q: How much does critical illness insurance cost? A: The cost varies depending on factors like age, health status, coverage amount, and the insurer. Obtaining quotes from multiple providers is recommended.

- Q: Can I get critical illness insurance if I have a pre-existing condition? A: It may be more challenging, and premiums might be higher. Disclosure of pre-existing conditions is crucial during the application process.

- Q: What happens if I am diagnosed with a critical illness not listed in my policy? A: You will not receive a payout. Carefully review the list of covered illnesses before purchasing a policy.

- Q: Can I claim critical illness insurance multiple times? A: Most policies only offer a single payout for each covered illness, although some policies might offer a second payout for recurrence of the same illness after a specific period.

- Q: Can I cancel my critical illness insurance policy? A: Yes, you can usually cancel your policy, but there might be penalties or surrender charges involved. Check the policy terms and conditions for details.

Conclusion

Critical illness insurance is a vital financial planning tool in 2025 and beyond. It offers a crucial safety net against the unexpected financial burden of a serious illness. By understanding its benefits and carefully selecting a suitable policy, you can protect yourself and your family from significant financial hardship during a challenging time. Don’t delay securing your financial future; contact an insurance professional today to explore your options.

References

While specific links to insurance companies are avoided to prevent bias, general information can be found on reputable financial websites and government resources. Search for terms like “critical illness insurance comparison,” “critical illness insurance benefits,” and “health insurance options” on your preferred search engine.

Call to Action

Protect your future. Get a free quote for critical illness insurance today and secure your financial well-being. Click here to find a reputable insurance provider near you!

Clarifying Questions

What illnesses are typically covered by critical illness insurance?

Coverage varies by policy, but common covered illnesses include cancer, heart attack, stroke, kidney failure, and major organ transplants.

How much coverage should I get?

The ideal coverage amount depends on your individual circumstances, including existing savings, income, and potential medical expenses. Consult a financial advisor for personalized guidance.

Can I get critical illness insurance if I have pre-existing conditions?

Insurers assess applications individually. Pre-existing conditions may affect your eligibility or premiums. Full disclosure is crucial during the application process.

How does critical illness insurance differ from health insurance?

Health insurance covers medical expenses, while critical illness insurance provides a lump-sum payment upon diagnosis of a specified critical illness, regardless of medical expenses.