In today’s fast-paced world, prioritizing health and financial security is paramount, especially for young adults. While youth often equates to invincibility, the reality is that critical illnesses can strike at any age. This article delves into the crucial reasons why securing critical illness insurance is no longer a luxury but a necessity for young adults in 2025 and beyond.

We’ll explore the rising costs of healthcare, the unpredictable nature of serious illnesses, and the peace of mind that a comprehensive critical illness plan can provide.

The Rising Tide of Healthcare Costs: A Young Adult’s Reality

Healthcare expenses are escalating at an alarming rate globally. The cost of treating critical illnesses like cancer, heart disease, stroke, and kidney failure can quickly drain personal savings and leave individuals and families facing crippling debt. For young adults, who are often still establishing their careers and financial stability, the financial burden of a critical illness can be particularly devastating.

A critical illness insurance policy acts as a financial safety net, providing a lump-sum payment that can cover medical expenses, lost income, and other related costs, alleviating significant financial stress during a challenging time.

Unexpected Medical Bills and Lost Income

- Hospitalization Costs: The cost of hospital stays, surgeries, and intensive care can be astronomical, even with health insurance.

- Medication and Treatment: Chemotherapy, radiation therapy, and other treatments for critical illnesses are incredibly expensive.

- Lost Wages: A critical illness often necessitates time off work, resulting in lost income and further financial strain.

- Long-Term Care: Recovery from a critical illness can be lengthy, potentially requiring extensive rehabilitation and long-term care, adding to the overall cost.

Critical Illnesses Don’t Discriminate: Age is No Barrier

Many young adults mistakenly believe that critical illnesses primarily affect older generations. While the risk increases with age, the reality is that critical illnesses can affect anyone, regardless of age or perceived health. Genetic predispositions, lifestyle factors, and unforeseen accidents can all contribute to the development of serious illnesses at a younger age. Proactive planning through critical illness insurance offers protection against the unexpected, ensuring financial stability even if the worst happens.

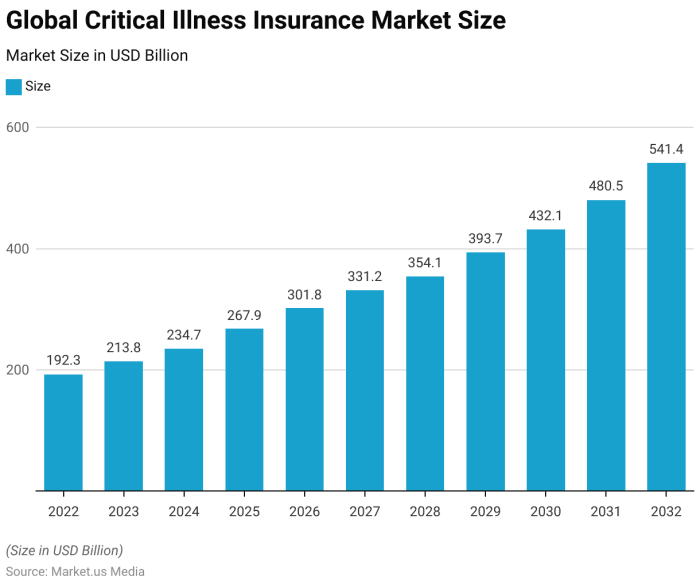

Source: market.us

Early Detection and Prevention: A Holistic Approach

While critical illness insurance provides financial security, it’s crucial to emphasize the importance of regular health check-ups, healthy lifestyle choices, and early detection of potential health issues. A holistic approach that combines preventative measures with financial protection is the most effective strategy for safeguarding long-term well-being.

The Benefits of Critical Illness Insurance for Young Adults

Critical illness insurance offers numerous benefits tailored to the specific needs of young adults:

- Financial Security: Provides a lump-sum payment to cover medical expenses, lost income, and other related costs.

- Peace of Mind: Offers reassurance and reduces financial anxiety associated with the potential of a critical illness.

- Debt Management: Helps manage and potentially eliminate medical debt, preventing long-term financial hardship.

- Future Planning: Allows young adults to focus on their future goals without the looming fear of unexpected medical expenses.

- Family Protection: Protects loved ones from the financial burden associated with a critical illness.

Choosing the Right Critical Illness Insurance Plan

Selecting the appropriate critical illness insurance plan requires careful consideration of individual needs and financial circumstances. Factors to consider include:

- Coverage Amount: Determine the appropriate coverage amount based on potential medical expenses and lost income.

- Covered Illnesses: Review the list of covered illnesses and ensure it aligns with your specific concerns.

- Premium Costs: Compare premiums from different insurers to find a plan that fits your budget.

- Policy Terms and Conditions: Carefully review the policy’s terms and conditions to understand the coverage limitations and exclusions.

- Insurer Reputation: Choose a reputable and financially stable insurer to ensure claim payouts are reliable.

Frequently Asked Questions (FAQ)

- Q: How much does critical illness insurance cost? A: The cost of critical illness insurance varies depending on factors such as age, health status, coverage amount, and the insurer. It’s advisable to obtain quotes from multiple insurers to compare prices.

- Q: What illnesses are typically covered? A: Commonly covered illnesses include cancer, heart attack, stroke, kidney failure, and other life-threatening conditions. Specific coverage may vary depending on the policy.

- Q: Can I get critical illness insurance if I have a pre-existing condition? A: Insurers may assess your health status and adjust premiums or coverage based on pre-existing conditions. It’s crucial to disclose all relevant health information when applying for insurance.

- Q: What happens if I make a claim? A: The claims process typically involves submitting required documentation to your insurer. Once approved, the lump-sum payment will be disbursed according to the policy terms.

- Q: Can I increase my coverage later? A: Some policies allow for increasing coverage in the future, subject to certain conditions and insurer approval.

Conclusion: Protecting Your Future, Today

Securing critical illness insurance is a proactive step towards safeguarding your financial well-being and protecting your future. For young adults in 2025, it’s no longer a matter of “if” but “when” to consider this essential form of protection. Don’t wait until it’s too late; take control of your financial future and secure your peace of mind with a comprehensive critical illness insurance plan.

Contact a qualified insurance advisor today to discuss your options and find the perfect plan to meet your individual needs.

References:

While specific sources for cost projections and illness statistics require dynamic data, you can consult these general resources for further information:

- World Health Organization (WHO)

-For global health statistics and information. - [Insert Link to a Reputable Insurance Comparison Website]

-For comparing insurance plans and costs. - [Insert Link to a Reputable Financial Planning Website]

-For general financial planning advice.

Call to Action:

Protect your future. Get a free quote for critical illness insurance today!

Question & Answer Hub

What types of illnesses are typically covered by critical illness insurance?

Policies typically cover a range of serious illnesses, including cancer, heart attack, stroke, kidney failure, and major organ transplants. Specific coverage varies by policy, so it’s crucial to review the policy details.

How much coverage should a young adult consider?

The appropriate coverage amount depends on individual circumstances, including lifestyle, existing debts, and desired level of financial security. Consulting a financial advisor can help determine the optimal coverage level.

Is critical illness insurance expensive for young adults?

Premiums are generally lower for younger, healthier individuals. Purchasing a policy early in life can lock in lower rates and provide long-term financial protection.

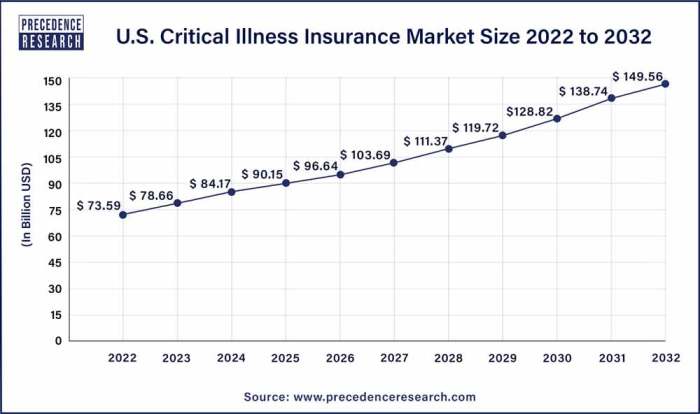

Source: precedenceresearch.com

Can I still get critical illness insurance if I have a pre-existing condition?

Some insurers may offer coverage, but it might come with exclusions or higher premiums. It’s essential to disclose all relevant medical history during the application process.